The UAE pension scheme is a critical aspect of employee benefits and HR compliance in the region. With the introduction of the General Pension and Social Security Authority (GPSSA) and recent updates to the UAE pension law, HR professionals must stay informed to ensure compliance and support their employees effectively. This article will break down everything HR needs to know about the UAE pension scheme, including its key features, eligibility criteria, and how it impacts businesses and employees.

What is the UAE Pension Scheme?

The UAE pension scheme is a government-mandated program designed to provide financial security to employees after retirement. It is regulated by the GPSSA and applies to both UAE nationals and expatriates working in the public and private sectors. The scheme ensures that employees receive a monthly pension after retirement, disability, or in the event of the employee’s death.

Key Features of the UAE Pension Law

- Eligibility Criteria

- UAE Nationals: Mandatory for all Emirati employees in the public and private sectors.

- Expatriates: Currently, only UAE and GCC nationals are eligible. However, expatriates may be covered under alternative end-of-service gratuity schemes.

- Contribution Rates

- Employees contribute 5% of their monthly salary.

- Employers contribute 12.5% for UAE nationals in the private sector and 15% for those in the public sector.

- The UAE government contributes 2.5% for Emirati employees.

- Pension Calculation

- The pension amount is calculated based on the employee’s average salary over the last three years of service and the total number of years contributed.

- Retirement Age

- The standard retirement age is 49 years, with a minimum of 20 years of service. However, employees can retire earlier under specific conditions.

Why is the UAE Pension Scheme Important for HR?

- Compliance with UAE Labor Laws

- HR departments must ensure that pension contributions are accurately calculated and paid on time to avoid penalties.

- Employee Retention and Satisfaction

- Offering a robust pension scheme enhances employee trust and loyalty, especially for UAE nationals.

- Financial Planning for Employees

- HR can educate employees about the benefits of the pension scheme, helping them plan for their future.

Recent Updates to the UAE Pension Law

In 2024, the UAE government introduced several updates to the pension scheme, including:

- Increased flexibility in early retirement options.

- Enhanced benefits for disabled employees.

- Improved pension calculation methods to ensure higher payouts.

These changes aim to align the UAE pension scheme with international standards and provide better financial security for employees.

Numeric Data: UAE Pension Scheme at a Glance

| Aspect | Details |

|---|---|

| Employee Contribution | 5% of monthly salary |

| Employer Contribution | 12.5% (private sector), 15% (public sector) |

| Government Contribution | 2.5% for UAE nationals |

| Retirement Age | 49 years (minimum 20 years of service) |

| Minimum Pension Amount | AED 10,000 per month |

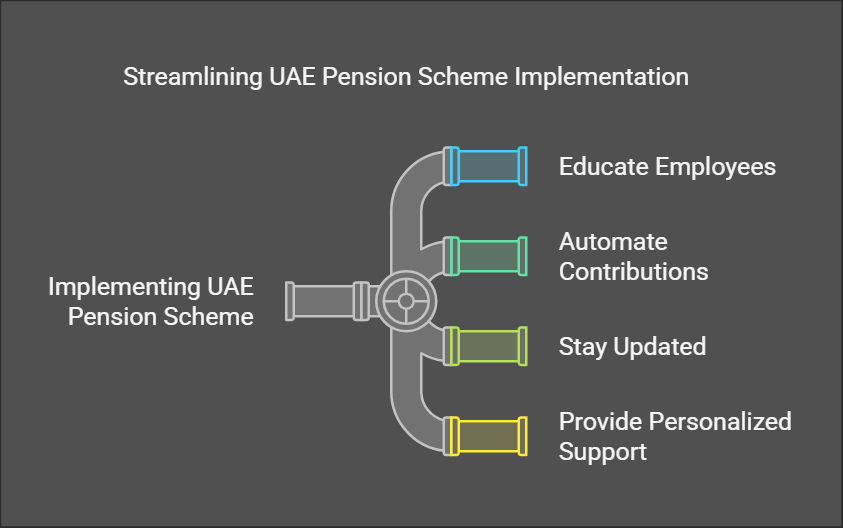

How HR Can Implement the UAE Pension Scheme

- Educate Employees

- Conduct workshops or webinars to explain the pension scheme’s benefits and processes.

- Automate Contributions

- Use HRMS software like MaxHR to automate pension calculations and payments.

- Stay Updated

- Regularly monitor updates from the GPSSA to ensure compliance with the latest regulations.

- Provide Personalized Support

- Offer one-on-one sessions to help employees understand their pension plans.

- Offer one-on-one sessions to help employees understand their pension plans.

Conclusion

The UAE pension scheme is a vital component of the country’s labor laws, ensuring financial security for employees after retirement. For HR professionals, understanding and implementing the scheme is crucial for compliance and employee satisfaction. By staying informed about the latest updates and leveraging tools like HRMS, HR departments can streamline pension management and contribute to their organization’s success.

FAQs

1. Who is eligible for the UAE pension scheme?

- UAE and GCC nationals working in the public and private sectors are eligible. Expatriates are not covered under this scheme but are entitled to end-of-service gratuity.

2. What is the minimum pension amount in the UAE?

- The minimum pension amount is AED 10,000 per month for eligible employees.

3. Can employees withdraw their pension contributions early?

- No, pension contributions cannot be withdrawn early except under specific conditions, such as disability or death.

4. How is the pension amount calculated?

- The pension amount is based on the employee’s average salary over the last three years of service and the total number of years contributed.

5. What are the penalties for non-compliance with the UAE pension law?

- Non-compliance can result in fines, legal action, and damage to the company’s reputation.

By addressing these FAQs and providing actionable insights, this article ensures that HR professionals are well-equipped to navigate the UAE pension scheme. For more information on HR compliance and HRMS solutions, visit MaxHR.io.