Overview

A competitive salary package is essential for attracting and retaining top talent in the UAE’s dynamic job market. With the rising cost of living and increasing demand for skilled professionals, companies must offer attractive compensation plans to stay competitive. This UAE Salary Guide provides insights into salary trends, key industries, benefits, and best practices to structure a compelling pay package. UAE Salary guide

Understanding UAE Salary Trends

The UAE job market is highly competitive, with salaries varying across industries and job roles. According to recent studies, salaries in the UAE have increased by 5%–7% in 2024, with some sectors experiencing even higher growth rates. UAE Salary Guide

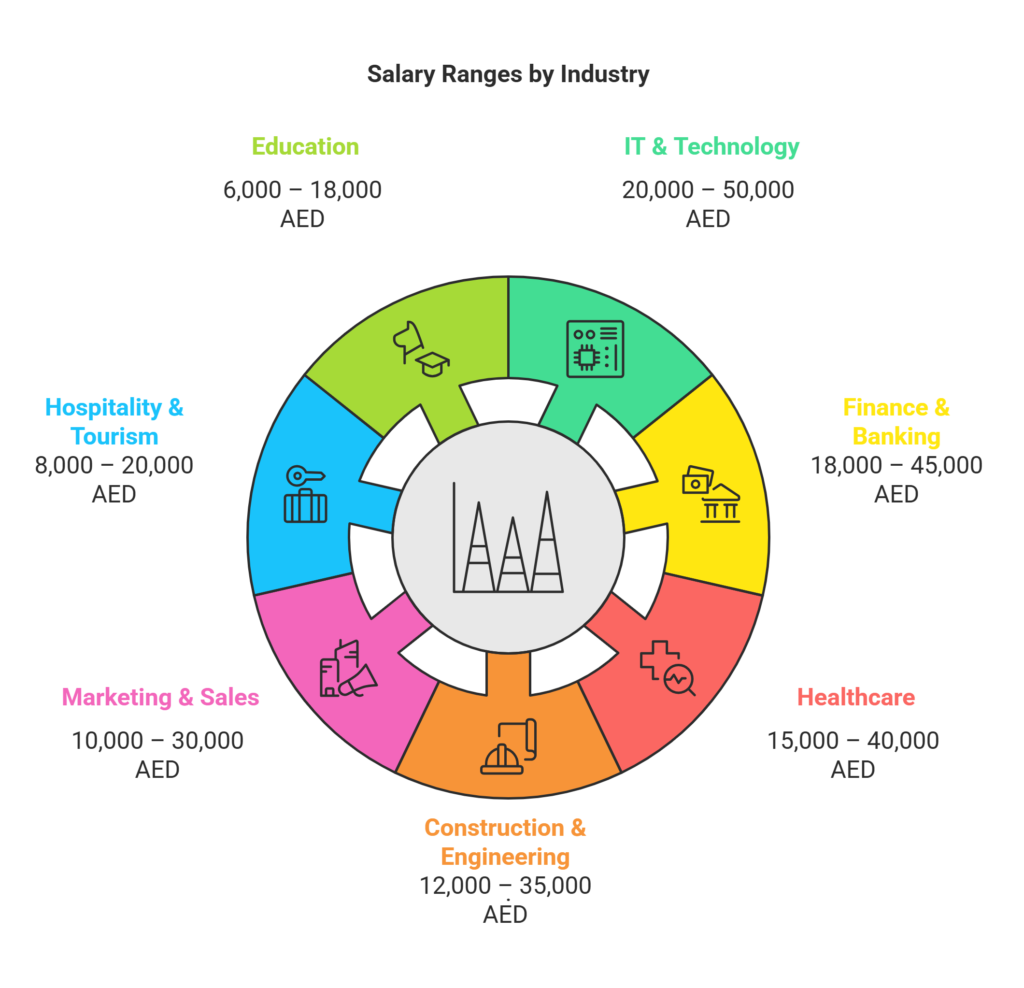

Average Salaries by Industry in UAE (2024)

| Industry | Average Monthly Salary (AED) |

|---|---|

| IT & Technology | 20,000 – 50,000 |

| Finance & Banking | 18,000 – 45,000 |

| Healthcare | 15,000 – 40,000 |

| Construction & Engineering | 12,000 – 35,000 |

| Marketing & Sales | 10,000 – 30,000 |

| Hospitality & Tourism | 8,000 – 20,000 |

| Education | 6,000 – 18,000 |

Factors Affecting Salary Structures in UAE

Several factors influence salary levels in the UAE, including:

- Industry Demand – High-demand sectors like IT and healthcare offer premium salaries.

- Experience Level – Senior professionals command higher pay than entry-level employees.

- Company Size & Reputation – Multinational companies typically offer better packages than startups.

- Location – Salaries in Dubai and Abu Dhabi are higher compared to other emirates.

- Cost of Living – Rising inflation and housing costs impact salary expectations.

Key Components of a Competitive Compensation Package

Beyond a basic salary, a well-structured package includes:

1. Base Salary

The fixed amount paid monthly, based on industry standards and job role.

2. Allowances & Benefits

| Benefit | Description |

| Housing Allowance | Covers accommodation costs, typically 20%–40% of salary. |

| Transportation Allowance | Covers commuting expenses, usually 5%–10% of salary. |

| Medical Insurance | Mandatory by UAE law for all employees. |

| Education Allowance | Provided for employees with children in school. |

| End-of-Service Gratuity | Employees receive 21 days per year of service as gratuity. |

3. Performance-Based Bonuses

- Annual or quarterly bonuses linked to KPIs and company performance.

- Stock options and profit-sharing for senior roles.

4. Work-Life Balance Benefits

- Flexible work schedules and hybrid work models.

- Paid annual leave (30 days for most employees).

- Wellness programs and gym memberships.

How to Offer Competitive Pay in UAE

To ensure competitive compensation:

- Benchmark Salaries – Research industry salary trends using market reports.

- Adjust for Inflation – Increase salaries annually to match the rising cost of living.

- Offer Unique Benefits – Provide retirement plans, childcare support, and training programs.

- Consider Tax-Free Benefits – Since the UAE has no income tax, benefits like housing and transport allowances can be attractive.

- Customize Packages – Tailor compensation based on employee experience, performance, and job role.

UAE Salary Guide Trends in 2025: Insights & Predictions

- Digital transformation is driving demand for AI, cybersecurity, and software development roles, pushing salaries up by 10%–15%.

- Sustainability and Green Energy sectors are experiencing 8% growth in salary packages due to new government initiatives.

- The rise of remote work has led to increased demand for hybrid work benefits.

Conclusion

Offering a competitive salary package in the UAE requires balancing market trends, employee expectations, and company budgets. Employers must continuously review compensation strategies to attract and retain top talent while staying aligned with industry standards.

FAQs

1. What is the average salary in the UAE?

Salaries vary by industry, but the average monthly salary ranges from AED 10,000 to AED 50,000, depending on the job role and experience.

2. Do UAE companies offer bonuses?

Yes, many companies provide performance-based bonuses, which can range from 5% to 20% of the annual salary.

3. Are salaries tax-free in the UAE?

Yes, UAE has no income tax, making it an attractive destination for professionals.

4. What benefits do employees in the UAE receive?

Common benefits include housing allowance, medical insurance, transportation allowance, and end-of-service gratuity.

5. How often should salaries be reviewed in the UAE?

Most companies review salaries annually, adjusting for inflation and market trends.