Overview

Payroll is one of the most critical yet time-consuming processes in HR. It involves calculating employee wages, managing taxes, and ensuring compliance with labor laws. When managed manually, payroll can be error-prone and stressful. But with automated HR software, businesses can streamline payroll, reduce mistakes, and improve employee satisfaction.

This blog explains how payroll works step by step, the role automation plays, and why modern HR platforms (like MaxHR and similar tools) are transforming payroll into a seamless experience.

How Payroll Works: A Direct Answer

Payroll works by collecting employee data (hours worked, salaries, benefits, deductions), applying compliance rules (taxes, contributions), and issuing payments to employees. Automated HR software handles these steps digitally—pulling data from attendance systems, calculating pay automatically, and generating tax-ready reports. This ensures accuracy, speed, and compliance compared to manual payroll systems.

Why Automating Payroll Matters in 2025

Manual payroll errors cost U.S. businesses billions annually. According to Deloitte, 49% of companies report payroll errors at least once a month, often leading to compliance fines and employee dissatisfaction. Automation eliminates these risks by:

-

Reducing human error in calculations

-

Ensuring tax compliance with automatic updates

-

Improving efficiency by cutting payroll processing time by up to 60%

-

Boosting employee trust through timely, accurate pay

The Step-by-Step Process: How Payroll Works with HR Software

1. Data Collection

-

Employee information: salary, contract type, allowances

-

Attendance and leave records

-

Benefits and deductions

2. Payroll Calculation

The system applies formulas to calculate gross pay, deductions (taxes, insurance), and net pay.

3. Compliance & Tax Handling

Automated HR software integrates updated labor laws and tax rules, ensuring businesses stay compliant without manual research.

4. Salary Disbursement

Payments are processed via direct deposit or integrated banking APIs.

5. Reporting & Auditing

Dashboards provide summaries, and audit logs simplify compliance checks.

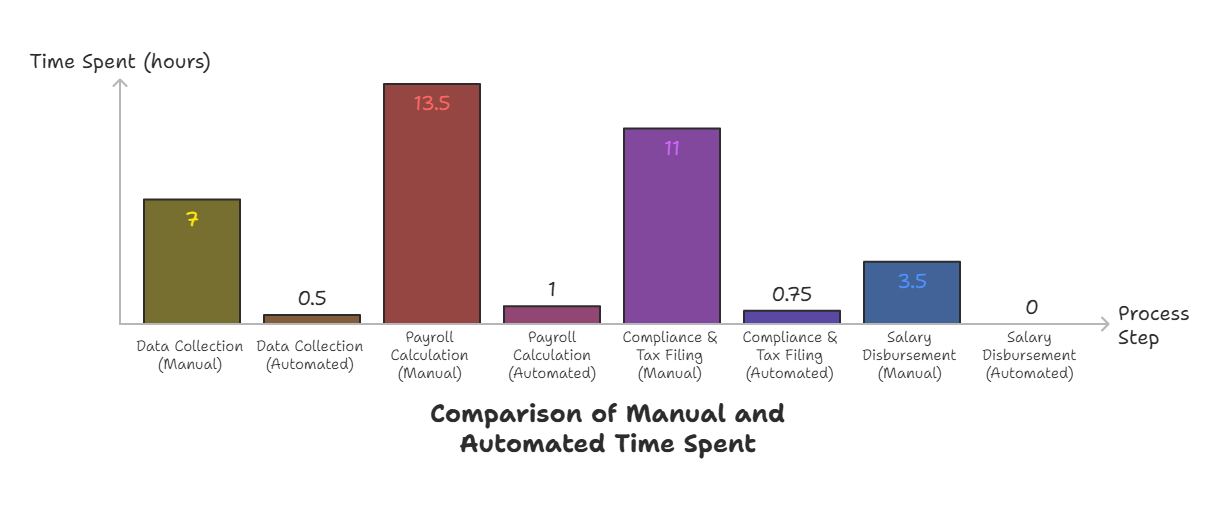

Payroll Automation in Numbers

| Process Step | Manual Time Spent (per 100 employees) | Automated Time Spent | Error Rate (Manual) | Error Rate (Automated) |

|---|---|---|---|---|

| Data Collection | 6–8 hours | 30 minutes | 12% | 1–2% |

| Payroll Calculation | 12–15 hours | 1 hour | 10% | <1% |

| Compliance & Tax Filing | 10–12 hours | 45 minutes | 15% | 2% |

| Salary Disbursement | 3–4 hours | Instant | 5% | 0.5% |

Source: Deloitte, PwC HR Tech Survey 2024

Benefits of Using Automated HR Software for Payroll

Benefits of Using Automated HR Software for Payroll

-

Time Savings – HR teams spend 70% less time on payroll with automation.

-

Cost Efficiency – Businesses save up to $100,000 annually by reducing payroll errors and compliance penalties.

-

Scalability – Whether managing 10 or 10,000 employees, automated systems scale effortlessly.

-

Integration – Payroll links with HR functions like recruitment, leave management, and benefits.

-

Employee Self-Service – Workers can access payslips, tax documents, and leave balances on demand.

Example: Tools like MaxHR and other modern HR suites help companies shift from reactive payroll management to proactive workforce planning.

How Payroll Automation Boosts Employee Satisfaction

Employees expect on-time and error-free pay. Automated payroll ensures transparency by providing digital payslips and self-service portals. Studies show that companies with automated HR payroll systems see a 25% increase in employee satisfaction because staff trust the system and HR teams have more time to focus on people, not paperwork.

Conclusion

Understanding how payroll works is essential for business success. Automated HR software reduces errors, improves compliance, and builds trust with employees. In 2025, companies that embrace payroll automation will not only save money but also position themselves as modern, employee-first workplaces. Platforms like MaxHR demonstrate that payroll doesn’t have to be a burden—it can be a strategic advantage.

FAQs: How Payroll Works with HR Software

1. How does payroll software calculate employee salaries?

Payroll software calculates salaries by pulling employee data (attendance, salary grade, deductions), applying tax rules, and generating the final net pay automatically.

2. Can small businesses use automated payroll systems?

Yes, small businesses benefit the most, saving time and avoiding costly compliance errors. Many platforms scale based on company size.

3. Is payroll software secure?

Modern systems use encryption, role-based access, and compliance with GDPR/CCPA to keep employee data secure.

4. How does payroll software handle taxes?

It automatically updates local and federal tax rules, calculates deductions, and generates tax-ready reports to file with authorities.

5. What makes MaxHR and similar HR platforms effective for payroll?

They integrate payroll with attendance, benefits, and compliance, reducing manual work while offering employee self-service tools for better transparency.