Why Payroll in the UAE Needs Clarity

Managing payroll in the UAE can feel overwhelming between Wage Protection System (WPS) compliance, end-of-service benefits, gratuity rules, and keeping up with local labor laws. For companies, payroll isn’t just about paying salaries; it’s about compliance, trust, and retaining top talent.

This guide breaks down everything you need to know about UAE payroll in 2025 from salary structures and WPS requirements to compliance risks and automation tips.

Many businesses now rely on HR and payroll platforms like MaxHR, which not only ensure compliance but also save time and reduce costly errors.

Payroll in the UAE: Key Components

Payroll in the UAE is unique compared to other regions because it integrates local labor law with mandatory government systems. Here are the essentials:

- Basic Salary – Forms the foundation of gratuity and benefits.

- Allowances – Housing, transport, and other allowances are often included.

- Overtime Pay – Governed by UAE labor law (typically 125–150% of the hourly rate).

- Deductions – Limited, but may include unpaid leave or disciplinary fines.

- End-of-Service Gratuity – Calculated based on years of service and final basic salary.

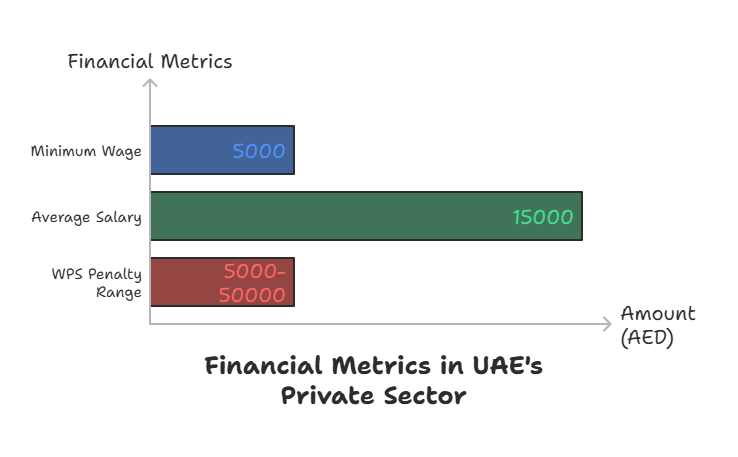

UAE Payroll Statistics 2025

| Metric | Value | Source |

| Minimum wage (private sector, Emiratis) | AED 5,000 | UAE Labor Law |

| Average salary in UAE (2025) | AED 15,000/month | GulfTalent |

| Overtime rate (standard) | 125% of hourly wage | UAE Labor Law |

| Penalty for WPS non-compliance | AED 5,000–50,000 | MOHRE |

| % of companies automating payroll | 72% | PwC HR Survey 2024 |

Wage Protection System (WPS): What Employers Must Know

The Wage Protection System is mandatory for all private-sector companies in the UAE. Employers must pay salaries electronically through banks or exchange houses approved by the Ministry of Human Resources & Emiratisation (MOHRE).

Failure to comply can lead to:

- Fines (AED 5,000 per employee, up to AED 50,000).

- Suspension of work permits.

- Legal action.

Tip: Many UAE businesses avoid penalties by using payroll automation platforms like MaxHR, which ensure seamless WPS file generation and compliance.

Payroll Compliance Checklist (2025)

To stay compliant and avoid penalties, UAE employers should ensure:

Salaries paid via WPS before the 10th of each month.

Accurate calculation of gratuity for resignations/terminations.

Payslips provided to employees.

End-of-service benefits settled within 14 days.

Record retention for at least 3 years.

End-of-Service Benefits (Gratuity) Explained

The UAE labor law mandates gratuity payments for employees completing at least one year of service.

Gratuity Calculation (2025):

- First 5 years: 21 days of basic salary per year.

- After 5 years: 30 days of basic salary per year.

- Maximum payout: 2 years of wages.

Example: If an employee earns AED 10,000/month and resigns after 6 years:

- Years 1–5: 21 × 5 = 105 days of salary.

- Year 6+: 30 days of salary.

- Total = 135 days = approx. AED 45,000 gratuity.

Payroll Challenges UAE Businesses Face

- Changing labor laws – Frequent updates in WPS, Emiratisation, and end-of-service rules.

- Multi-currency & multi-location payroll – Especially for companies with international staff.

- Compliance risks – Heavy fines for late or incorrect salary processing.

- Manual errors – Still common in businesses that rely on spreadsheets.

Companies that switch to automated payroll platforms like MaxHR reduce processing errors by up to 70%, while also saving valuable HR time.

Automating Payroll: Why It’s the Future

With 72% of UAE companies already using HR tech for payroll, automation is no longer optional.

Benefits of automation with solutions like MaxHR:

- Instant WPS-compliant salary files.

- Automatic gratuity & leave balance calculations.

- Reduced compliance risks.

- Employee self-service portals for payslips, leave requests, and expense claims.

Best Practices for UAE Payroll in 2025

- Stay Updated: Monitor MOHRE and UAE labor law updates.

- Use Payroll Software: Manual processes increase compliance risk.

- Educate Employees: Transparent payroll builds trust.

- Integrate HR & Finance: Reduces duplication and ensures accuracy.

- Audit Regularly: Catch errors before they become penalties.

Final Thoughts

Payroll in the UAE isn’t just about paying employees it’s about compliance, efficiency, and employee trust. With stricter WPS enforcement and evolving labor laws, the cost of mistakes is high.

That’s why many UAE businesses now rely on HR tech platforms like MaxHR to simplify payroll, ensure compliance, and free up HR teams to focus on people, not paperwork.

If your company wants to streamline payroll while staying 100% compliant, MaxHR can help you get started today.